Estilo

Publicidad - Sigue leyendo debajo

Publicidad - Sigue leyendo debajo

Beatrice Borromeo con pantalón verde de cuadros

La Reina se viste de invitada de firma española

La Reina con falda satinada y top de escote bardot

Tamara Falcó con el traje más original y exclusivo

Amelia Bono con short de leopardo y blusa negra

Isabel Preysler con traje de cuadros

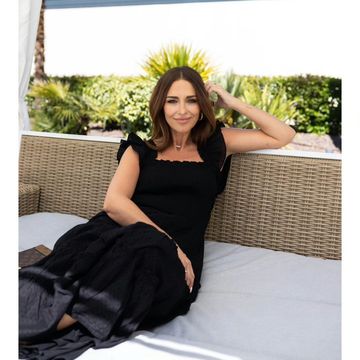

Carmen Lomana, la invitada ideal a sus 75 años

Pilar Rubio: look de flamenca con lencería

Publicidad - Sigue leyendo debajo

Keanu Reeves y Alexandra Grant reaparecen

Keanu Reeves y Alexandra Grant: cómo se conocieron

Tana Rivera, invitada de The IQ Collection